Introduction

Ever feel like your paycheck disappears before the month ends? Managing money can seem overwhelming, but with the 50/30/20 rule, you can budget your income like a pro. This simple and flexible framework helps you allocate your earnings wisely to cover your needs, enjoy your wants, and grow your savings.

Let’s dive into what the 50/30/20 rule is and how you can use it to take control of your finances.

What is the 50/30/20 Rule?

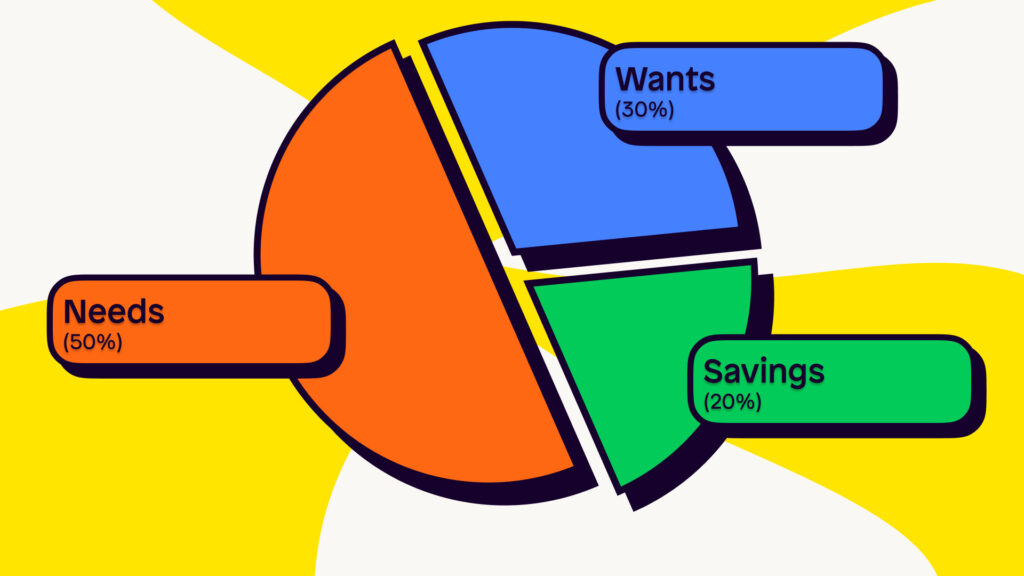

The 50/30/20 rule is a budgeting guideline that divides your income into three main categories:

- 50% for Needs: Essentials like housing, food, utilities, and transportation.

- 30% for Wants: Non-essentials like dining out, entertainment, and hobbies.

- 20% for Savings and Debt Repayment: Emergency funds, investments, and paying off loans.

Why It Works:

This rule is simple to follow, flexible for different incomes, and ensures you balance enjoying life and securing your financial future.

Step-by-Step Guide to Using the 50/30/20 Rule

Step 1: Calculate Your After-Tax Income

Your after-tax income is the amount you take home after deductions like taxes, health insurance, and retirement contributions.

- Salaried Employee: Check your paycheck or online portal for your net pay.

- Freelancer or Business Owner: Subtract taxes and business expenses from your gross income to get your net pay.

Step 2: Allocate 50% for Needs

Essentials are your non-negotiable expenses, such as:

- Rent or mortgage payments.

- Utility bills (electricity, water, internet).

- Groceries and basic transportation.

Pro Tip: If your needs exceed 50%, consider cutting back on discretionary spending or downsizing where possible.

Step 3: Dedicate 30% to Wants

This category includes things you enjoy but don’t necessarily need, such as:

- Movie nights or Netflix subscriptions.

- Traveling or weekend getaways.

- Dining out with friends.

Pro Tip: Be mindful of overspending. If you’re saving for a bigger goal, consider temporarily reducing spending in this category.

Step 4: Save or Pay Off Debt with 20%

Use this portion to build your financial future:

- Savings: Emergency fund, retirement account, or investing in stocks.

- Debt Repayment: Pay down high-interest loans or credit card balances.

Pro Tip: Automate your savings and payments to stay consistent.

Benefits of the 50/30/20 Rule

- Easy to Follow: Simple percentages make budgeting less overwhelming.

- Financial Balance: You’re saving for the future while enjoying the present.

- Customizable: Adjust percentages slightly based on your income and goals.

Common Challenges and How to Overcome Them

- High Cost of Living:

- Solution: Reduce discretionary spending and shop smart for essentials.

- Irregular Income:

- Solution: Base your budget on your average monthly income and adjust as needed.

- Too Much Debt:

- Solution: Prioritize debt repayment by reducing the “Wants” category temporarily.

Bonus Tips for Sticking to the 50/30/20 Rule

- Use budgeting tools like Mint or YNAB to track expenses automatically.

- Review your budget monthly and adjust for unexpected changes.

- Set specific savings goals to stay motivated, like building a $5,000 emergency fund.

Conclusion

The 50/30/20 rule is a powerful yet simple way to manage your money like a pro. By dividing your income into needs, wants, and savings, you can take charge of your financial future without sacrificing what you love. Start today and watch your finances transform with this practical budgeting method.

Investopedia: The 50/30/20 Rule – Learn more about how it works.