Introduction

Have you ever reached the end of the month and wondered where all your money went? A personal budget is the ultimate solution to gaining control over your finances. It’s not just about restricting spending; it’s about empowering yourself to prioritize what truly matters. In this step-by-step guide, we’ll show you how to create a personal budget that works for your unique lifestyle and financial goals.

Why Do You Need a Personal Budget?

A budget isn’t about saying “no” to spending it’s about saying “yes” to financial freedom. Here’s what a personal budget can do for you:

- Reduce Financial Stress: Know exactly where your money is going.

- Achieve Goals Faster: Save for that dream vacation or emergency fund.

- Avoid Debt: Live within your means and avoid unnecessary loans

Step 1: Understand Your Income

Start by calculating your total monthly income. Include:

- Salary (after taxes).

- Freelance or side hustle earnings.

- Other income sources like dividends or rental income

Pro Tip: Use a budgeting app like Mint or YNAB to track your income automatically.

Step 2: Track Your Expenses

For at least one month, monitor where your money goes. Break your expenses into categories, such as:

- Fixed Expenses (rent, utilities, insurance).

- Variable Expenses (groceries, dining out, entertainment).

- Discretionary Spending (subscriptions, hobbies).

Step 3: Set Financial Goals

Define your short-term and long-term goals. Examples:

- Short-term: Save $500 for holiday gifts.

- Long-term: Save for a down payment on a house.

Having clear goals will help you stay motivated and focused.

Step 4: Choose a Budgeting Method

Pick a budgeting method that suits your lifestyle:

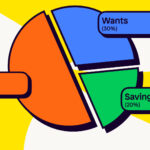

- 50/30/20 Rule:

- 50% for needs (housing, food).

- 30% for wants (entertainment, shopping).

- 20% for savings or debt repayment.

- Envelope System: Use cash for specific categories and stop spending once the envelope is empty.

- Zero-Based Budget: Allocate every dollar to a category until you reach $0.

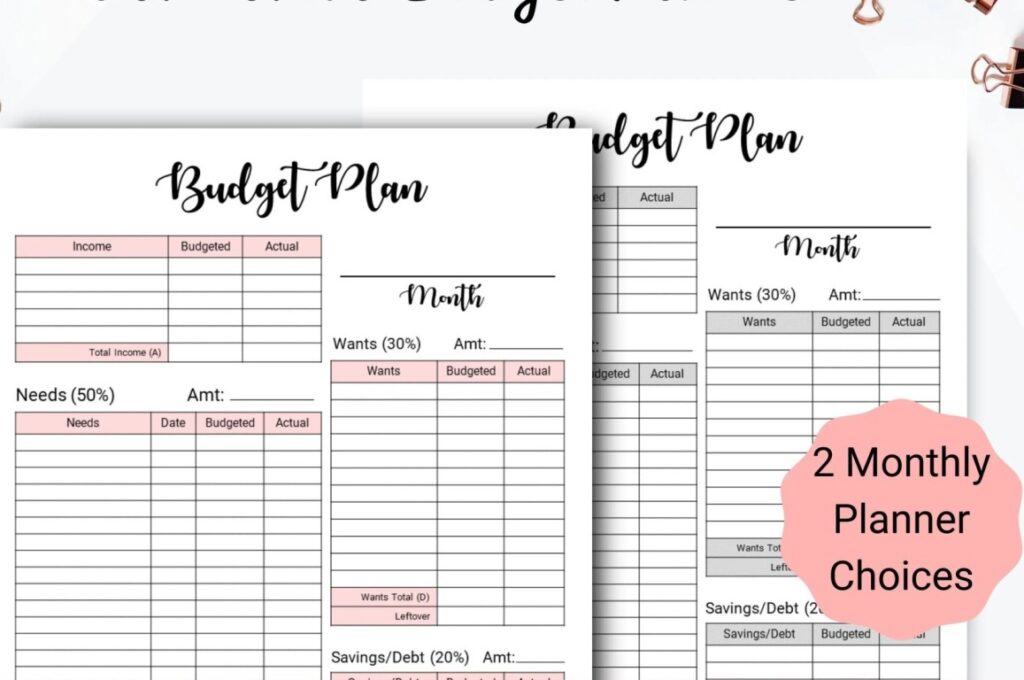

Step 5: Create and Stick to Your Budget

Now that you have your numbers, build your budget. Use tools like spreadsheets or apps to organize your categories and amounts.

Pro Tip: Review your budget weekly to ensure you’re staying on track. Adjust as necessary for unexpected expenses.

Step 6: Automate Savings and Payments

Set up automatic transfers for savings and bill payments. This ensures:

- You never forget to save.

- You avoid late fees on bills.

Step 7: Review and Adjust Regularly

Life changes, and so should your budget. Review your budget monthly to:

- Track progress toward your goals.

- Adjust for new expenses or changes in income.

Bonus Tips to Make Budgeting Easier

- Use Budgeting Apps: Tools like EveryDollar or Goodbudget make tracking easy.

- Eliminate Unnecessary Expenses: Cancel unused subscriptions or memberships.

- Celebrate Small Wins: Reward yourself when you hit milestones, like paying off a debt or reaching a savings goal.

Conclusion

Creating a personal budget isn’t complicated it’s empowering. By following this step by step guide, you’ll take control of your finances and build a future of financial freedom. Start today, and let your budget work for you not against you.

Reference Investopedia’s Financial Goals Guide for more insights on setting realistic financial objectives.