Introduction

Life is unpredictable. Whether it’s a sudden job loss, medical emergency, or unexpected home repair, financial surprises can strike at any time. Having an emergency fund ensures you’re prepared to tackle these challenges without stress.

In this guide, we’ll discuss why an emergency fund is essential and How to Build an Emergency Fund, even on a tight budget.

Why an Emergency Fund is Essential

An emergency fund acts as a financial safety net. Here’s why you need one:

- Covers Unforeseen Expenses: Avoid relying on high-interest loans or credit cards.

- Protects Your Savings: Keeps your long-term savings and investments untouched.

- Reduces Stress: Provides peace of mind knowing you’re financially prepared.

How Much Should You Save?

Experts recommend saving at least three to six months’ worth of living expenses. However, if this feels overwhelming, start small. Even $500-$1,000 can cover many unexpected costs.

Steps to Build Your Emergency Fund

1.Set a Savings Goal

Define how much you need to save based on your monthly expenses. Break it down into manageable milestones to stay motivated.

- Example: Aim for $1,000 as a starting goal.

2. Create a Budget

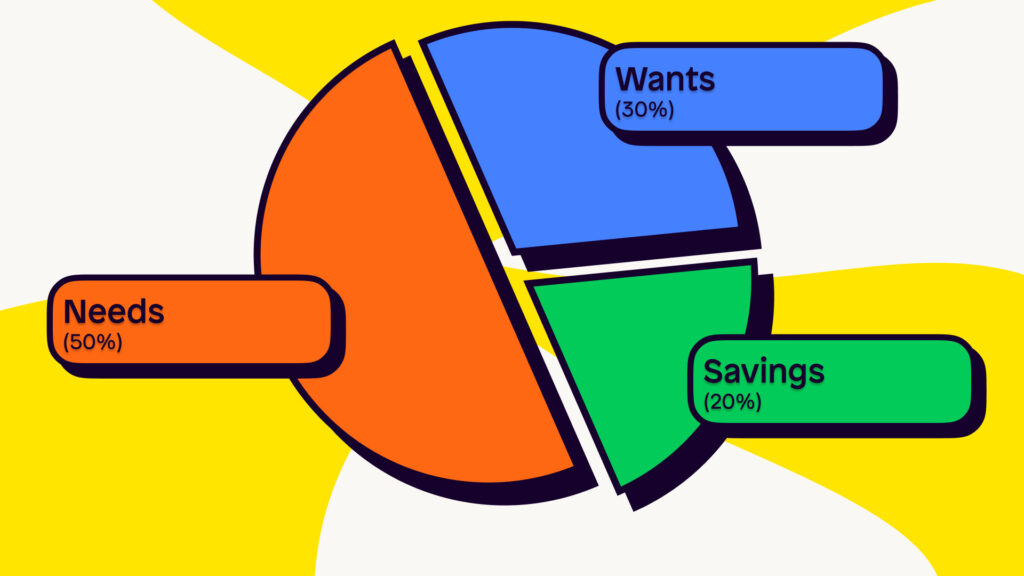

Review your income and expenses to find areas to cut costs. Use the 50/30/20 rule:

- 50% for needs: Rent, utilities, groceries.

- 30% for wants: Dining out, entertainment.

- 20% for savings: Allocate this to your emergency fund.

3. Automate Your Savings

Set up automatic transfers to your savings account every payday. This ensures consistency without needing to think about it.

4. Reduce Non-Essential Spending

Identify areas to save money:

- Skip daily coffee runs or eat out less.

- Cancel unused subscriptions or memberships.

Pro Tip: Redirect this money into your emergency fund.

5. Use Windfalls Wisely

Tax refunds, bonuses, or unexpected earnings can boost your savings. Resist the urge to splurge and deposit them directly into your fund.

6. Open a Dedicated Account

Keep your emergency fund separate from your regular checking or savings account. This reduces the temptation to dip into it for non-emergencies.

7. Stay Consistent and Patient

Building an emergency fund takes time. Celebrate small wins and stay focused on your goal.

Where to Keep Your Emergency Fund

Choose an accessible but secure place for your fund:

- High-Yield Savings Account: Offers interest while keeping funds liquid.

- Money Market Account: Combines savings and checking features with higher interest rates.

Common Mistakes to Avoid

- Relying on Credit: An emergency fund prevents debt accumulation.

- Using the Fund for Non-Emergencies: Stick to true emergencies like medical bills or car repairs.

Conclusion

Building an emergency fund is a crucial step toward financial stability. By setting a clear goal, creating a budget, and staying consistent, you can secure your future and handle life’s surprises with confidence. Start today your future self will thank you!

NerdWallet’s Guide to Savings Accounts – Explore high-yield savings accounts.