Introduction

Budgeting has never been more important, and with 2024 comes a fresh lineup of budgeting apps designed to simplify financial management. Whether you’re a beginner or a seasoned saver, these apps can help you track expenses, cut unnecessary spending, and achieve your financial goals.

Let’s explore the best budgeting apps for 2024, their features, and how they compare.

Why Budgeting Apps Are Essential

Gone are the days of manual budgeting with pen and paper. Budgeting apps offer:

- Convenience: Access your budget anytime, anywhere.

- Accuracy: Automatically track expenses and categorize spending.

- Insights: Analyze spending habits and make informed financial decisions.

Top Budgeting Apps for 2024

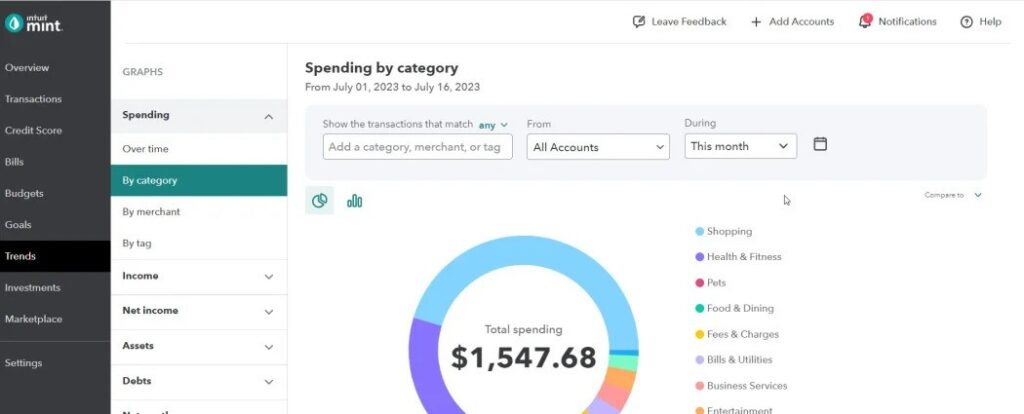

1. Mint

Best for: Beginners and all in one financial management.

Features:

Tracks expenses, budgets, and bills in one place.

Provides personalized insights to help you save.

Free to use with optional premium features.

Pros: Easy to set up, intuitive interface.

Cons: Occasional ads in the free version.

2. YNAB (You Need A Budget)

Best for: Detailed budgeters and goal-oriented users.

Features:

Focuses on giving every dollar a job.

Helps you save for long term goals like retirement or debt payoff.

Syncs seamlessly with your bank accounts.

Pros: Excellent customer support, educational resources.

Cons: Subscription cost of $14.99/month.

3. PocketGuard

Best for: Simplifying spending tracking.

Features:

Automatically shows how much “pocket money” you have after bills.

Links to all accounts for real-time tracking.

Offers a built-in savings tool.

Pros: Great for avoiding overspending.

Cons: Limited customization compared to others.

4. Goodbudget

Best for: Envelope budgeting enthusiasts.

Features:

Digital “envelopes” for different spending categories.

Share budgets with family members.

Free version supports up to 10 envelopes.

Pros: Ideal for couples or families.

Cons: Lacks automatic expense tracking.

5. Emma

Best for: Tracking subscriptions and wasteful spending.

Features:

Identifies recurring subscriptions and unused memberships.

Suggests ways to save money.

Offers a fun and interactive user experience.

Pros: Great for millennials and Gen Z users.

Cons: Subscription features can be pricey.

How to Choose the Right App

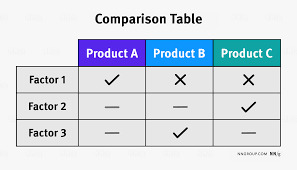

When selecting the best budgeting app for your needs, consider:

- Your Financial Goals: Are you saving, reducing debt, or managing daily expenses?

- Ease of Use: Look for apps with simple interfaces.

- Features vs. Cost: Balance functionality with affordability.

Benefits of Using Budgeting Apps

- Save time with automated tracking.

- Gain insights into spending habits.

- Set and achieve financial goals effortlessly.

Conclusion

The best budgeting apps for 2024 offer tools to manage your money efficiently and effectively. Whether you prefer simplicity or detailed tracking, there’s an app to suit your needs. Start today and take control of your financial future with these top-rated apps.

PocketGuard Official Website – Check how PocketGuard works.